It's not that Superman Comics don't have their moments, like here in #148:

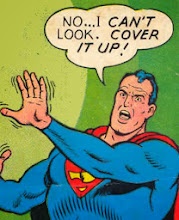

... It's just that I enjoy seeing Superman look like a fool more than I like seeing him win. And I know that's not what anyone was going for, but I just can't help myself.

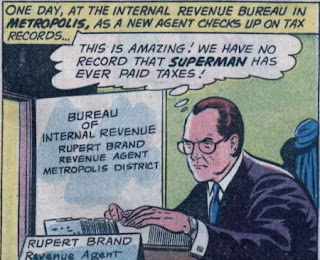

Like this awesome bit:

What? Well, what are going to DO about it, Revenue Agent Rupert Brand?

I'm listening! Go on!

Preach, Rupert Brand! PREACH!

So, since NO ONE ESCAPES THE INTERNAL REVENUE SERVICE, Superman gets audited in a CMNS Moment.... of Comic Book Greatness! (tm!)

You know it'll be ruined in the end, but for now: Watching Superman get audited is a CMNS Moment.... of Comic Book Greatness! (tm!)

That's hardcore, but hey... don't cross swords with the Internal Revenue Service.

Superman: Ivory Hunter.

Yes. You see it. So do I. That's DC's flagship hero right there, folks. But what's a bunch of massacred elephants when Superman is running low on cash, right?

Jerk.

What?

For the record, I tried to see about "Code 1426B" in the Internal Revenue Code and I can't find it. Any tax pros out there want to help me out?

Again... WHAT?

You never thought of that because it's SHENANIGANS!

There are all kinds of rules to claim a dependent, but let's consider for one stark-raving insane second that everyone in America qualified as Superman's dependent. This means that no one else gets to claim their dependents because Superman just claimed them all. That means every taxpayer with a dependent is now on the hook with the I.R.S. But as long as Superman is happy, to blazes with everyone else, right?

And look at him. He's totally fine with it.

Egad. The way people just fall all over themselves for this guy is nauseating. Yeesh.

See you tomorrow!

3 comments:

The ordinance quoted by Mr. Brand's boss, "1426c", was in all probability misprinted by the letterer instead of "26 USC §1441 (c)(4)", which provides that "[u]nder regulations prescribed by the Secretary, compensation for personal services may be exempted from deduction and withholding", if said services are rendered by a "non-resident alien". Superman, being from Krypton and dwelling at the Fortress of Solitude, certainly qualified for said exemption. The boss, however, had to be backed by the brass at the Dept. of the Treasury when waiving a $ 1 bn fine (7.98 bn in 2015 dollars)!

Good call, Cfl! And you're probably right... I'd like to read the regs that cover Superman's doings! But the whole "we're all his dependents" thing? That's quite a stretch. Not that I'd be above doing it myself....

Also, if you want to get technical, the IRS agent threatens to "order the FBI" to arrest Superman. I doubt if the IRS can "order" the FBI to do anything; the two bureaus are not even in the same department. If someone were to be arrested for tax evasion, I would assume that the IRS's own agents would do it, or else they would get a warrant from a federal judge, and then US Marshals would track down and arrest the person.

And using the logic presented in this story, could firefighters and paramedics deduct as "dependents" the people they've rescued? Could police S.W.A.T. teams and military Special Operations (Delta Force, Navy SEALs) units take deductions for the hostages they rescue?

Post a Comment